Dhanteras Gold vs Digital Gold vs Smart Investments: Complete Comparison

Thursday, Sep 25, 2025

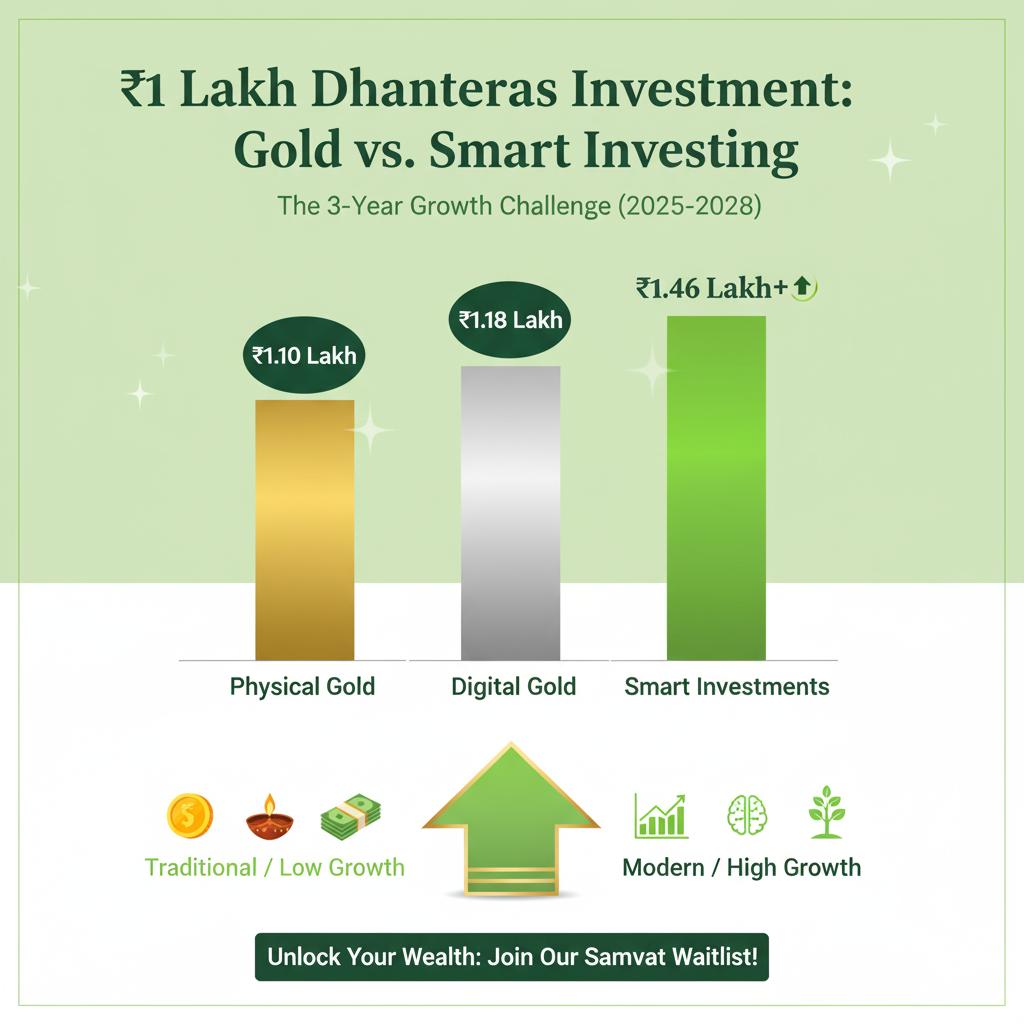

If you put ₹1 lakh across these three options, what happens after 3 years?

Millions of Indians celebrate every Dhanteras by purchasing gold. Others take jewelry, others use coins, many have now turned to digital gold. But here is the real question. What would happen to 1 lakh of your investments in smart investments, such as a portfolio of the best Diwali stocks to invest in, muhurat shares to invest in, or stocks to invest in before Diwali? You may be surprised with the three-year results.

This article is an unbiased, mathematical, and clear comparison of physical gold, digital gold, and smart investments. We will dissect the expenses, revenues, and back doors nobody speaks about. At the end, you will know which option is better to meet your goals this festive season. And in case you are serious about making your wealth work harder, there is an exciting option of becoming part of the Green Portfolio Waitlist early access to professionally managed smallcases.

Why do people still prefer Physical Gold during Dhanteras?

How do you purchase physical gold and what costs are involved?

- Jewelry purchases come with making charges that range between 8 to 15 percent.

- Wastage charges and design premiums reduce your effective value.

- Gold coins and bars are priced above the spot rate and attract GST of 3 percent.

What about storage, security, and insurance?

- Storing jewelry at home poses theft risk.

- Bank lockers require yearly fees and involve hidden costs like GST.

- Insurance to protect your gold adds another recurring cost.

Is physical gold liquid and easy to resell?

- Jewelers deduct 5 to 10 percent when you sell your jewelry back.

- Resale requires hallmarking verification which takes time.

- Immediate cash is rarely available without compromising on price.

What are the real returns after three years?

Suppose gold appreciates at 8 percent annually. On ₹1 lakh, the notional value after three years would be around ₹1.26 lakh. Subtract making charges, GST, and resale deductions, your effective value might shrink closer to ₹1.10 lakh. That is a modest return for an asset considered auspicious but not wealth-creating.

Why has Digital Gold become the modern convenience choice?

How do digital platforms simplify gold buying?

Platforms like Paytm, PhonePe, and Google Pay allow you to buy gold starting from as little as ₹10. The gold is stored in insured vaults and you receive digital ownership proof.

What hidden costs exist in digital gold?

- Platform storage fees are often not visible upfront.

- Buy-sell spreads can be higher than physical gold.

- Long-term holding is limited because digital gold is not officially regulated as a financial security.

How liquid is digital gold?

- Redemption is quick, usually within 24 hours.

- You can sell at prevailing market rates, though spreads eat into returns.

- Physical delivery is possible but comes with making and delivery charges.

What about taxation?

- Digital gold is treated as a capital asset.

- Short term gains are taxed as per your slab.

- Long term capital gains apply after 3 years at 20 percent with indexation.

What would ₹1 lakh in digital gold look like in 3 years?

If gold grows at the same 8 percent rate, your holdings may reach about ₹1.26 lakh. Subtract buy-sell spreads and possible platform charges, you may be left with ₹1.18 to ₹1.20 lakh. Slightly better than physical gold, but still limited in growth potential.

What makes Smart Investments a better choice beyond gold thinking?

How does diversification help investors?

Gold is a single-asset investment. Smart investments spread your ₹1 lakh across carefully chosen best Diwali stocks, shares to buy before Diwali, and long-term growth opportunities. This reduces risk and enhances potential upside.

Can smart investments beat inflation?

Equity-based portfolios historically deliver 12 to 15 percent annualized returns over the long term. That comfortably beats inflation and grows wealth faster than gold.

Why does professional management matter?

With Green Portfolio’s smallcases, investors get access to:

- Research-backed stock selection.

- Tactical entry into stocks to buy this Diwali.

- Continuous rebalancing to protect against downside risk.

How does diversification reduce risk?

A well-curated smallcase does not rely on just one stock or sector. Exposure is balanced across themes, ensuring you do not lose sleep over market volatility.

What would ₹1 lakh in smart investments become after 3 years?

At an average 14 percent compounded growth, ₹1 lakh grows to about ₹1.48 lakh in three years. Even after accounting for smallcase fees, your effective returns would remain far ahead of gold.

What does the head-to-head math show?

Let us compare a simple 3-year ₹1 lakh investment scenario.

|

Option |

Assumed Annual Growth |

Value after 3 years |

Costs involved |

Final Value |

|

Physical Gold |

8 percent |

₹1.26 lakh |

Making, GST, resale cuts (15k) |

₹1.10 lakh |

|

Digital Gold |

8 percent |

₹1.26 lakh |

Platform fees, spreads (6-8k) |

₹1.18–1.20 lakh |

|

Smart Investments |

14 percent |

₹1.48 lakh |

fees (2-3k) |

₹1.45–1.46 lakh |

Who wins?

- For tradition and emotional value, physical gold still appeals.

- For convenience and short-term liquidity, digital gold looks slightly better.

- For wealth creation, smart investments clearly outperform.

This Diwali, ask yourself. Do you want your money to simply sit in lockers or do you want it to work harder in Diwali best stocks to buy and shares to buy before Diwali?

What is the perfect blend this Dhanteras?

Imagine a portfolio that gives you the trust of gold, the convenience of digital platforms, and the power of smart investments. That is what Green Portfolio smallcases are designed for.

- You get access to carefully chosen stocks to buy for Diwali.

- You ride the festive momentum of the markets during muhurat trading.

- You diversify beyond gold into growth-oriented opportunities.

This Dhanteras, you can be part of something bigger. Join the Green Portfolio Samvat Waitlist and get early access to curated investment strategies that blend tradition with smart modern investing.

Why should you act now and not wait?

Festivals like Dhanteras and Diwali are not just cultural celebrations but also psychological triggers for new beginnings. Every year, markets witness a surge in demand for muhurat shares to buy and best stocks to buy during Diwali. Historically, muhurat trading sessions have delivered positive returns.

If you delay, you miss out on the momentum of stocks to buy before Diwali and the chance to secure a strong entry point. Acting early allows you to ride the wave from Dhanteras to New Year. Imagine entering the New Year with a portfolio already seeded in New Year best stocks to buy.

Conclusion: What is the smarter recommendation this Dhanteras?

If you value emotion and tradition, buy a small token of physical gold. If you want easy liquidity, digital gold is convenient. But if your goal is true wealth creation, the clear recommendation is to step into smart investments.

₹1 lakh in physical gold after 3 years may give you ₹1.10 lakh. ₹1 lakh in digital gold may reach ₹1.18 lakh. But ₹1 lakh in smart investments can compound to ₹1.46 lakh or more.

This festive season, do not just purchase wealth symbols. Build real wealth. Be among the first to explore Green Portfolio’s Samvat Waitlist and access carefully chosen smallcases filled with the best stocks to invest this Diwali and beyond.

Dhanteras is about prosperity. Make your prosperity smarter this year.

Talk to an expert

Talk to an expert