Your Gateway to Smart Wealth Creation

Invest in meticulously researched, high-growth opportunities.

Tailored solutions to match your investment goals.

Trusted by investors for transparency and results.

Invest in meticulously researched, high-growth opportunities.

Tailored solutions to match your investment goals.

Trusted by investors for transparency and results.

Green Portfolio PMS is designed for investors seeking personalized, actively managed portfolios. It’s an ideal fit for those looking to maximize returns while diversifying across high-potential sectors.

Our PMS solutions consistently deliver superior returns, outperforming traditional investment benchmarks with a robust strategy backed by data and research.

Green Portfolio PMS is benchmarked against leading indices to ensure transparency and accountability, enabling you to measure performance effectively.

Valuation metrics and sectoral tailwinds.

Financial stability is screened with manageable debt levels, the balance sheet, and cash flow.

Corporate governance, including the promoter history, board structure, and related party transactions for our portfolio companies.

Preference to companies with a strong business moat

Factory visits, management engagements, and reassessments of target prices.

Particularly leaders in niche industries with sustainable competitive advantage.

Stocks are sold when the target price range is achieved, the investment thesis is met ahead of time, or when the thesis fails.

The investment objective of the PMS business is to consistently grow our investor's wealth through d...

The objective of this fund is to provide a very high reward but with a higher than usual risk...

The objective of the fund is to generate dividends along with capital appreciation for investors, th...

The objective of the fund is to deliver consistent capital appreciation by investing in multi-nation...

Stocks in this fund are backed by companies that respect strong ESG pillars....

An actively managed, Shariah-compliant PMS focused on ethical, long-term wealth creation....

Easily Estimate Your PMS Fees and Optimize Your Investment Strategy

| Returns | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|

| AT THE BEGINNING OF THE YEAR | |||||

| NAV at beginning of period ... (A) | |||||

| DURING THE YEAR | |||||

| Return during the year |

%

|

%

|

%

|

%

|

%

|

|

Gross Portfolio Value at end of the year BEFORE contract note charges, BEFORE Operating Expenses |

|||||

| Net Value of the Portfolio at end of the year | |||||

| Net return to client | |||||

CEO, Co-Founder

With over 15 years of experience in managing investments in the stock market, and being an MBA from Indian School of Business Hyderabad, Divam is a member of The Institute of Chartered Accountants of India. Divam has been the driving force of the company since its inception. He is responsible for customer management, business development and research, and has played a pivotal role.

Research Partner, Co-Founder

Anuj heads the research team that has been consistently outperforming the Sensex. With over 5 years in Financial Consultancy and 15 years of investing in the stock market, along with being a Member of The Institute of Chartered Accountants of India, He plays a crucial role in the investments that Green Portfolio allocates to special stocks.

Let us know your query and someone from our team will get back to you within 24 hours.

Get Started with PMS

Sunday, Jun 1, 2025

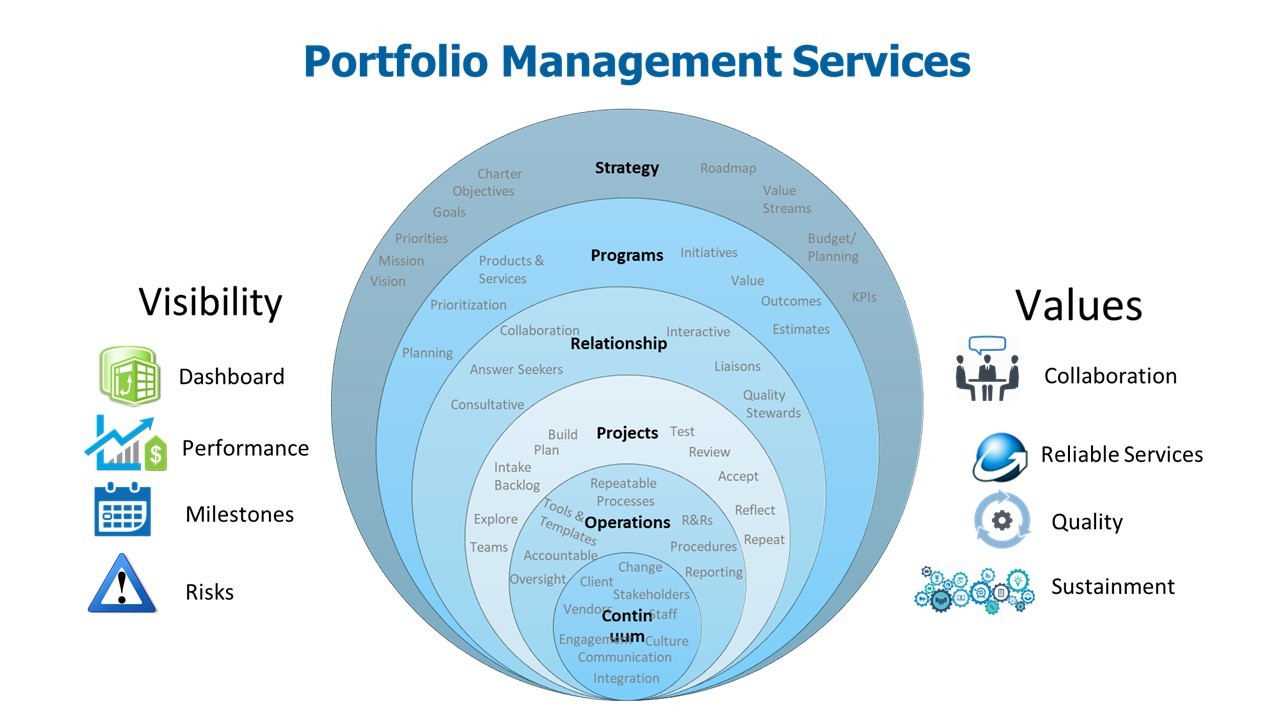

A portfolio management service (PMS) refers to the practice of having a third party (often a professional fund manager) over see an investor's or business's collection of financial assets. Based on the client's financial goals, risk tolerance, and time horizon, PMS crafts individualized and expert investment strategies.

Financial instruments such as equities, bonds, mutual funds, and more may be pooled together and managed by a professional fund manager in a professionally managed account (PMS). The fund manager uses his or her knowledge to determine how to allocate capital and carry out any necessary transactions in order to help investors meet their financial goals.

High-net-worth individuals and institutions might benefit from PMS's individualized investment approach if they are seeking an alternative to more common investment vehicles like mutual funds and exchange-traded funds (ETFs). By tracking their investments' performance and keeping tabs on the fund manager's investment decisions, PMS gives investors more information, more options, and more say over their portfolios.

Depending on the institution, asset management firms or investment banks may impose a monetary threshold for investing in PMS. Management fees, performance fees, or both may be charged for PMS, depending on the size of the investment and the sophistication of the investment strategy employed.

To put it simply, portfolio management services enable clients to have their own diversified investment portfolios managed by professionals. Based on the client's financial goals, risk tolerance, and time horizon, these services aim to optimize returns while minimizing risk.

Following are the common procedures of a portfolio management service:

Understanding the client's investment objectives: The client and the portfolio manager will get down to talk about the client's investment objectives, comfort level with risk, and expected return. The manager can then use this information to develop a personalized investment plan.

Developing an investment strategy: The portfolio manager will create an investment plan that takes into account the client's goals and level of comfort with risk. The goal is to maximize returns while avoiding risk, which may necessitate investing in a variety of assets.

Selecting investments: The investment strategy will serve as the basis for the portfolio manager's selection of appropriate investments. For this purpose, an advisor may examine a client's risk tolerance and return expectations to decide which stocks, bonds, or other investments are fit.

Monitoring the portfolio: The portfolio manager will keep an eye on the investments they've chosen to make sure they're still in line with the client's financial goals and comfort level with risk. In order to maximize returns or limit risk, the manager may make appropriate changes to the portfolio.

Reporting to the client: The portfolio manager will keep the customer updated on the status of the portfolio on a regular basis. These reports will detail the returns, fees, and other key data.

The overarching goal of portfolio management services is to aid customers in achieving their financial objectives through the provision of professional advice and management of their investment portfolio.

Green Portfolio’s Portfolio Management service offers you personalized goal-based investment management solutions for each user tailored to their personal goals and investment needs. We are a research house focused on financial portfolio and asset management.

We believe in buying growth and quality companies that are undervalued, have strong fundamentals, are cash-rich, with low debt, and have strong management.

Not only this, we are disinclined toward PSU. Anti fragility, the ability to generate incremental returns, and improving operating margins are a few parameters that we look into before investing in a company. We strictly adhere to our core tenets and investment principles which have been the foundation of our PMS.

The benefit of PMS is the asset diversification involved. PMS is professionally managed by experienced fund managers with investment decisions complimenting technical and fundamental analysis.

Investment in PMS enables investors to achieve a customized portfolio in line with their financial plans. Investors can discuss their financial goals with the fund manager and invest the amount accordingly.

Every PMS comes with a transparent fee structure, giving the investor freedom to choose the suited for him amongst the options available.

PMS and fund managers are tightly monitored by regulations. Portfolio managers are required to periodically submit transaction statements, holdings, assets under management, and costs to the regulator which further protects the investor’s interests.

As PMS usually has a concentrated stock portfolio, it has a better chance to generate superior returns over the underlying index.

SEBI Registered– We are a SEBI registered firm bound by the long-term strategy of wealth creation for our investors.

Diversified Solution- We split the investment amount among our strategies based on your goals and risk profile.

Continuous Monitoring- We have a dedicated research team to monitor the trends, making changes to the portfolio as and when necessary.

Transparency- We have curated a Customized Dashboard for tracking performance, downloading research reports, etc. You can also interact with the team for all research rationale.

Green Portfolio, rated as PMS in India, brings quality research with accessibility and ease of use to the investor. Our team of research analysts provides original research for our users to invest in the Equities Markets. Since our inception, we have been one of the performing portfolio management services in India consistently. We are amongst the performers with high alpha and low drawdown, with the in category performance in mid-caps and small caps.

Portfolio management services come in a variety of flavors, each with its own specializations and methods. Some of the most frequent forms of portfolio management include the following:

Active portfolio management: Active portfolio management is a strategy where the portfolio is actively managed by the manager in an effort to outperform the market. While active management often comes with a greater price tag and the possibility of higher fees, it also offers the possibility of larger returns.

Passive portfolio management: Investment in a diversified portfolio of assets is made and held for the long term with minimal trading under passive portfolio management. Investors seeking steady, long-term returns may benefit more from this strategy, which is typically less expensive than active management.

Strategic portfolio management: Portfolios are managed strategically when the client's investment objectives, risk tolerance, and expected investment horizon are all taken into account. The portfolio is then managed in accordance with the established strategy, with course corrections made as necessary.

Tactical portfolio management: Short-term rebalancing of a portfolio in reaction to market fluctuations or other economic events is an example of tactical portfolio management. This strategy may involve capitalizing on prevailing market conditions or avoiding potentially dangerous investments.

Socially responsible portfolio management: Investing in companies seen as socially responsible or environmentally benign, while avoiding those seen as destructive to society or the environment, is the goal of socially responsible portfolio management.

Robo-advisory portfolio management: Investment portfolio management using automated algorithms; sometimes known as "robo-advisory" or "robot advisor." If you're an investor searching for a low-cost, hands-off strategy, this may be a viable alternative because it's cheaper than traditional portfolio management services.

Portfolio management services are expert assistance for handling one's stock of investments. Portfolio management services provide the following advantages:

Spreading your investments over many different types of assets, industries, and geographical areas is one way to diversify your portfolio, which a portfolio manager may help you do. Investment risk can be mitigated by diversification.

Experience and education: Portfolio managers have both, making them experts in the field. They have easy access to resources that allow them to do the necessary study and analysis before investing.

Personalization: A portfolio manager may craft an investing strategy that takes into account your unique needs, objectives, and risk tolerance. When your needs and priorities shift over time, they may also adapt your portfolio accordingly.

Saving time: Maintaining a portfolio of investments is a time-consuming and complicated task. If you hire a portfolio manager to handle your investments, you'll have more time for other pursuits.

A portfolio manager can assist you in controlling your investment risk by keeping tabs on the market and making adjustments as needed. They can also give you information and updates on the status of your portfolio on a regular basis.

Effective tax management: a portfolio manager may help you invest in a way that reduces your taxable income.

Those who desire professional assistance in managing their financial portfolios may find portfolio management services to be useful. If you outsource your portfolio management needs to a professional, you can take advantage of their knowledge and experience to help you reach your financial objectives. Portfolio managers are experts in the financial markets, the economy, and investment techniques; as a result, they can make educated judgments on their customers' behalf. Managing a portfolio of investments may be a time-consuming task, so this can be a big help.

Portfolio management services provide a number of benefits, including access to professionals, time savings, and a diversified portfolio that can help mitigate risk. You may tailor your portfolio to your individual investment objectives and risk tolerance with the assistance of a professional portfolio manager, who can also help you find fresh investment possibilities you might have missed. Portfolio managers can make adjustments as needed to reflect your changing objectives and comfort level with risk.

The administration of an investment portfolio entails a series of steps known together as the portfolio management process. The usual procedures for this are as follows:

Setting up Goals: Investing goals and objectives are outlined as the first phase in the portfolio management process. The investor must first determine their investment objectives, level of risk acceptance, investment horizon, and other variables.

Asset Allocation: The next phase is asset allocation, or choosing a mix of investments that reflects the investor's risk tolerance and return expectations. Among these is determining the appropriate mix of stocks, bonds, cash, and other investment vehicles.

Security Selection: After settling on an asset allocation strategy, the next step is to choose specific assets or funds to invest in. This entails analyzing various assets based on things like financial statements, market trends, and risk.

Portfolio Monitoring: The portfolio is reviewed on a regular basis by the portfolio manager to ensure it is still meeting the investor's needs. This entails checking in on the portfolio's status, studying market tendencies, and making necessary changes.

Rebalancing: The asset allocation of a portfolio may alter over time as a result of fluctuations in the market, necessitating periodic rebalancing. The portfolio manager may periodically rebalance the portfolio by purchasing or selling assets in order to keep the asset allocation target constant.

Reporting: Portfolio performance reporting is the last stage of the portfolio management process. This entails updating the investor on a consistent basis with reports detailing the portfolio's performance, holdings, and any other pertinent data.

PMSs provide prospective clients with sample portfolios to use while evaluating the service. The PMS model portfolio may be compared to a market index to see how well it has done in the past in picking and holding onto companies.

The portfolio's success or failure hinges entirely on how well the manager does relative to the market. Hence, researching the PMS's track record is an essential part of the selection process. A portfolio manager's value to a fund may be gauged by looking at their academic and professional credentials.

Another factor that may provide PMS an edge over competing plans on the market is the investing approach. Before putting down money, the investor should have a firm grasp of the approach. The plans' long-term viability should be clearly articulated if they are complicated.

There ought to be mutual benefit from the PMS's performance-based pricing structure. The standard rate of return for profit sharing is 20%. The fund's management fee shouldn't be more than 3 percent annually, which is the average for similar funds. A management will get compensation only if the fund's return exceeds a certain "hurdle rate."

Investors, particularly those with discretionary accounts, place a premium on responsiveness and openness to feedback. It is common for PMSes to gain from client involvement and develop a lasting agreement when evaluating portfolio performance.

Many people who have some capital to invest choose PMS because they expect larger returns from their investments. Investment returns that are commensurate with risk continue to be emphasized.

Several individuals choose PMS because it provides a reliable source of income. The primary goal of a portfolio manager is to ensure the safety of investor funds while also generating stable returns.

Many investors choose PMS because of its high liquidity, or its ability to be quickly converted into cash. If they require capital to launch their company, this is an absolute must. When this is the case, the portfolio manager constructs individualized portfolios to meet the cash flow requirements of their customers.

In order to maximize the after-tax return of assets, PMS places a strong emphasis on tax planning. The tax efficiency of investments should be considered during the portfolio construction process. Capital appreciation and greater after-tax returns are two of the main benefits of PMS.

The market regulator has been making efforts to make the PMS business as investor-friendly as the MF industry. In order to continue exercising control, SEBI must guarantee uniformity and openness in the reporting structure. Comparisons have been made between the expense ratios of mutual funds and the fee structures of PMSes across different schemes. The regulatory ecosystem in India should keep pace with the surge in demand for PMS to prevent its mis-selling or misuse.