Trusted by 65,000+ investors worldwide!

Trusted by 65,000+ investors worldwide!

Unlock better performance, clarity, and confidence.

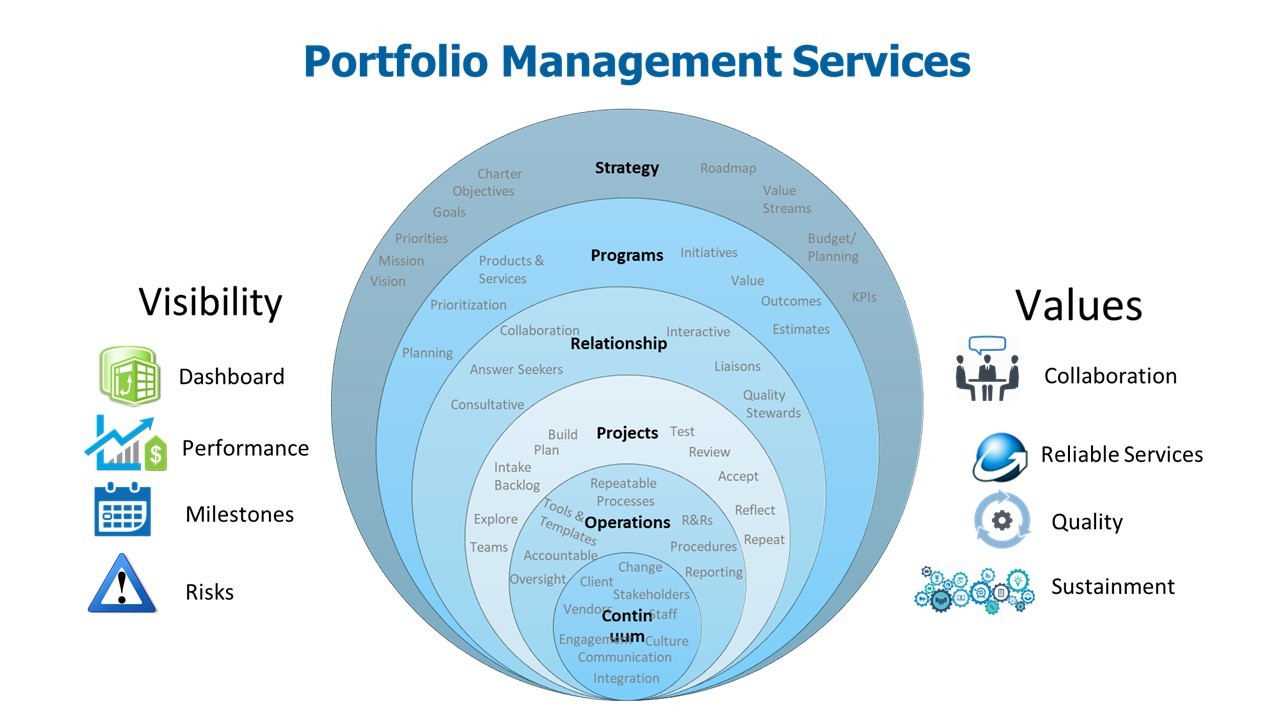

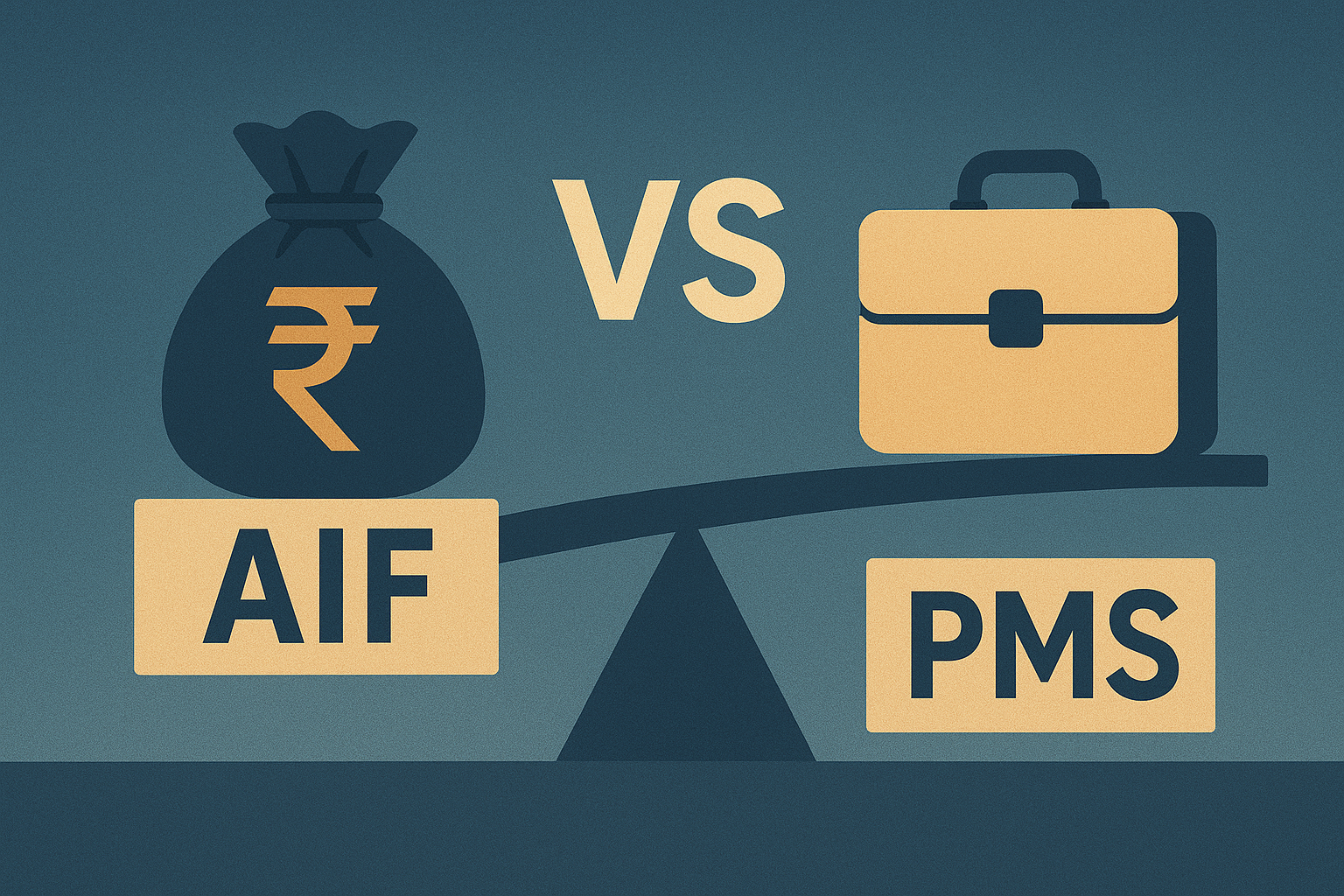

Invest across smallcases, PMS, and AIF..

We balance your portfolio to match your risk appetite while aiming for strong, consistent returns. Active monitoring helps us stay ahead of market shifts.

Every investor is unique. We offer personalized portfolios, direct access to experts, and services tailored to your financial goals.

We follow strict SEBI guidelines and data security protocols to keep your investments safe and fully compliant at all times.

See what our clients say about their sustainable investment journey

After trying a few strategies, I wanted something I could stick with for years. The DiviGrowth smallcase is easy to track, and the dividend tilt suits my long-term plan. Plus the updates explain changes clearly without over-communicating.

CEO, Shell Lubricants

24.3%

24.3%

I came to Super 30 PMS for customization and tighter risk alignment, not excitement. The portfolio feels high-conviction but measured, and the team has stayed consistent through different market phases while keeping my goals front and center.

Investment Banker

32.7%

32.7%

I was spending too much time second-guessing my own trades. High Quality Right Price smallcase gave me a fundamentals-led way to participate in India’s growth story, and the structure has helped me stay calm and consistent instead of reacting emotionally.

Business Owner

18.4%

18.4%

Trend-chasing has proved expensive in the past, especially when markets turn. With Super 30 PMS, I’ve liked the discipline: fewer ideas, stronger research, and a clear focus on fundamentals and risk control that makes it easier to stay invested during volatility.

Business Owner

20.7%

20.7%

Reach out to us, and we will answer all your queries!

Get answers in minutes!

Have questions about sustainable investing? Our experts are ready to help you right away on Whatsapp.

Talk To An Expert

Talk To An Expert

Prefer a scheduled consultation? Book a free call with our sustainable investment advisors.

Book A Free Call

Book A Free Call

Divam Sharma brings over two decades of experience in wealth management, client advisory, and business leadership. As the CEO and Co-Founder of Green Portfolio, a SEBI-registered Portfolio Management Services (PMS) firm, Divam leads the firm's strategic direction, client relationships, and business ...

Read More

Anuj Jain is the Chief Investment Officer and Co-Founder of Green Portfolio, where he leads the research team and chairs the investment committee. With over 15 years of hands-on equity investing experience and 5+ years in financial consultancy, Anuj is the architect behind the firm's investment proc...

Read More

Sunday, Jun 1, 2025

Get in touch with us and we will solve all your investment related queries!

Book a free call

Book a free call

Talk to an expert

Talk to an expert

Personalized strategies. Proven returns. Seamless onboarding.