How Are Securities Held in Portfolio Management Services? Complete Guide for Residents & NRIs

Tuesday, Dec 2, 2025

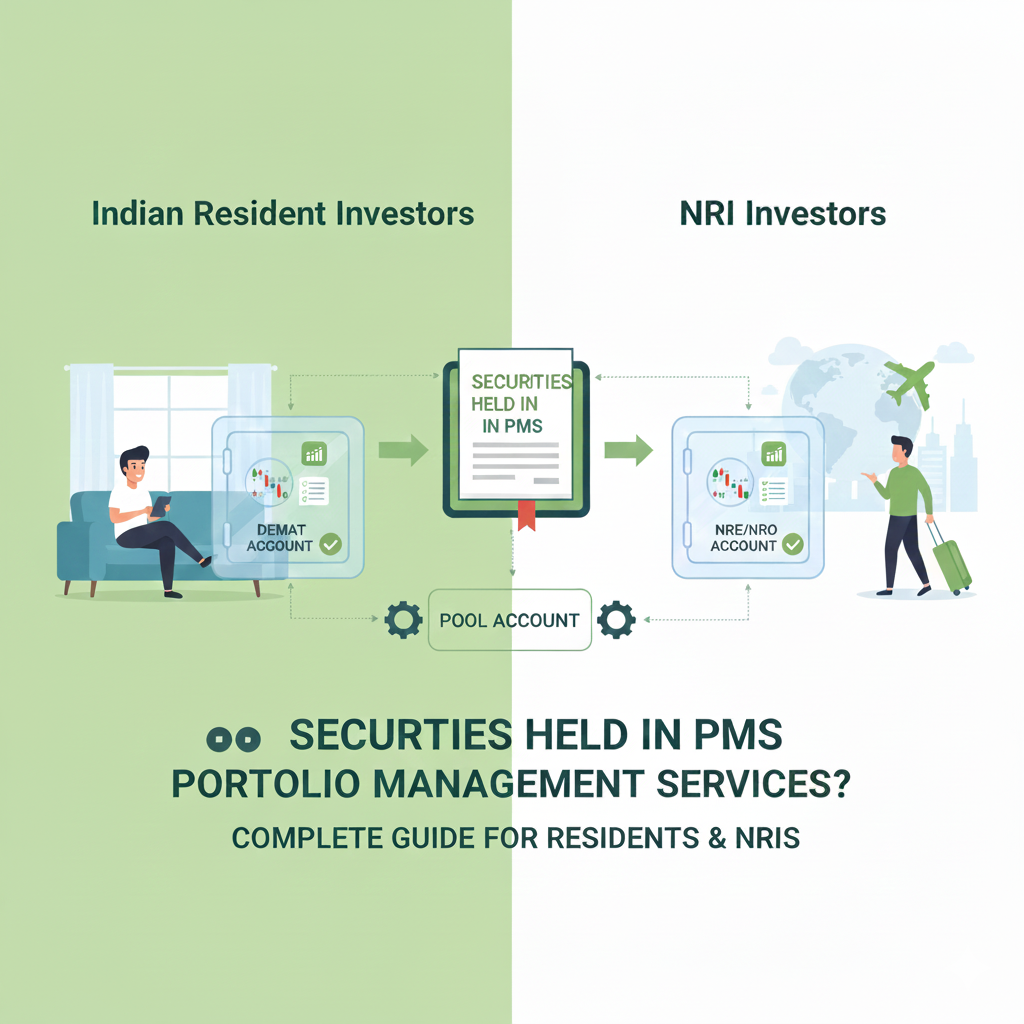

One of the most common questions first-time PMS investors ask is: "Where exactly are my securities and funds held?" Unlike mutual funds where you own units in a pooled structure, Portfolio Management Services (PMS) offer segregated accounts where you retain direct ownership of your investments. Understanding how custody and fund management work—especially the differences between resident and NRI accounts—is crucial before committing to a PMS investment.

Where Are Your Securities Held in PMS?

In a SEBI-registered PMS, your securities are always held in a demat account opened in your own name with an approved custodian or depository participant. This means you legally own the shares, bonds, or other securities in your portfolio—not the PMS provider. The portfolio manager has the authority to execute transactions on your behalf, but ownership remains with you throughout the investment period.

For resident investors, shares and other listed securities are held in a demat account opened specifically for the PMS with a custodian or depository participant, typically a large bank. The demat account carries your name and PAN, with assets segregated client-wise as mandated by SEBI regulations.

NRI investors follow a similar structure, but with additional regulatory requirements. Your equity and other securities are held in a custodian demat account tagged to you, often with the same bank acting as custodian. Your holdings are recorded separately from other PMS clients and from the PMS provider's proprietary assets, ensuring complete segregation.

How Are Funds Managed in PMS?

The handling of cash and funds differs slightly between resident and NRI PMS accounts due to regulatory requirements.

For Resident Investors

Cash that you transfer to the PMS typically goes into a PMS pool bank account maintained by the portfolio manager with a scheduled commercial bank. This account is legally separate from the manager's own funds and is used exclusively for client investments and related credits or debits. SEBI regulations mandate that portfolio managers maintain this "clients' funds" account with proper records of all client-wise credits, debits, dividends, interest, and corporate action benefits.

For NRI Investors

NRI investors face additional compliance requirements under FEMA (Foreign Exchange Management Act) and RBI regulations. A dedicated NRE (Non-Resident External) or NRO (Non-Resident Ordinary) bank account is opened solely for PMS investments. Where applicable, this account is often PIS-designated (Portfolio Investment Scheme) to comply with RBI guidelines for NRI equity investments.

The PMS and its banking partner use this account structure to route your funds in and out as per FEMA and RBI rules. This ensures that all capital flows—whether inward remittances, dividend credits, or redemption proceeds—follow the prescribed regulatory framework for non-resident investors.

What Does SEBI Regulation Say About Custody?

SEBI regulations are explicit about client asset protection in PMS structures. Portfolio managers are required to segregate each client's funds and securities from their own proprietary assets and maintain separate client-wise accounts—whether the client is a resident or NRI.

While portfolio managers may maintain a combined bank account for all clients' funds, it must be a distinct "clients' funds" account with meticulous records. Every credit (capital infusion, dividends, interest) and debit (withdrawals, fees, expenses) must be tracked at the individual client level, ensuring complete transparency and accountability.

This regulatory framework provides robust protection: even if the PMS provider faces financial difficulties, your securities and funds remain ring-fenced in segregated accounts under your legal ownership.

Quick Comparison: Resident vs NRI PMS Custody

| Aspect | Resident PMS Client | NRI PMS Client |

|---|---|---|

| Where shares are held | Client-specific demat with custodian/DP in your name | Client-specific demat with custodian/DP in your name |

| Where cash is held | PMS pool/clients' bank account with scheduled bank | NRE/NRO (often PIS) account plus PMS clients' bank account as per setup |

| Legal owner of securities | Always the client (you), not the PMS | Always the client (you), not the PMS |

Why Does This Custody Structure Matter?

Understanding custody is critical for three reasons:

Transparency and Control: Unlike pooled investment vehicles where you own units, PMS gives you visibility into every security held in your name. You can see your exact holdings in your demat account at any time.

Regulatory Protection: The segregated account structure means your assets are protected even in scenarios where the PMS provider faces operational or financial challenges. Your securities cannot be used for the provider's liabilities.

Tax Efficiency: Since you own securities directly in your name, capital gains taxation happens at your individual level. You have more control over tax-loss harvesting, holding periods, and timing of exits compared to pooled structures.

What Questions Should You Ask Your PMS Provider?

Before investing, clarify these custody and operational details:

-

Which bank or institution will act as custodian for your demat account?

-

How will dividends, interest, and corporate action benefits be credited?

-

What is the process for reviewing your holdings and transaction statements?

-

For NRIs: Is the account structure PIS-compliant? How are repatriation and tax certificates handled?

-

What happens to your securities if you decide to exit the PMS?

How Green Portfolio Handles Custody

At Green Portfolio, we follow all SEBI-mandated custody and segregation requirements for both resident and NRI clients. Your securities are held in client-specific demat accounts with approved custodians, and all funds are maintained in designated client bank accounts with scheduled commercial banks.

We provide complete transparency through regular portfolio statements, transaction confirmations, and direct access to custodian records. For NRI investors, we handle the complete PIS/NRE/NRO account setup and ensure seamless compliance with FEMA and RBI regulations.

Our research-driven investment process is backed by robust operational infrastructure, giving you peace of mind that your assets are secure, segregated, and managed professionally.

The Bottom Line

In SEBI-registered PMS, you retain legal ownership of all securities held in segregated demat accounts in your name, whether you're a resident or NRI investor. Your funds sit in designated client bank accounts—not in the PMS provider's personal accounts—with full regulatory oversight and client-wise record-keeping.

This custody structure combines the professional management of a PMS with the transparency and control of direct equity ownership, offering institutional-grade portfolio management without sacrificing asset safety. Whether you're a resident investor seeking active portfolio management or an NRI looking for compliant access to Indian equities, understanding how custody works is the first step toward confident PMS investing.

Ready to explore professionally managed portfolios with complete transparency? Explore Green Portfolio PMS and discover how research-driven investing can work for your wealth goals.

Talk to an expert

Talk to an expert