Equity Portfolio Management

Whether it’s through a portfolio manager or EPM (Equity Portfolio Management) consulting, having experts by your side ensures better decision-making.

Contact Us

Whether it’s through a portfolio manager or EPM (Equity Portfolio Management) consulting, having experts by your side ensures better decision-making.

Contact Us

It’s definitely a great feeling to watch your equity portfolio in it’s glory when the majority of your companies are performing great. You deserve a pat on your back for sure. But do you usually still maintain the same composure amidst a market downturn? How do you react to it?

Now that’s a real concern to consider for sure.

Managing your portfolio is seemingly a complicated task. Watching over its performance and making strategic alterations requires an in depth understanding of the markets as well as an overall awareness of global financial trends. While it’s not impossible to personally take care of your portfolio, expertise in creating and understanding financial modeling, making appropriate allocation decisions of the underlying assets that make up your portfolio, and recognizing the inherent value of the various financial modes and vehicles is relevant.

After all, managing an investment portfolio is no simple task.

While some individuals manage their portfolios independently, seeking professional advice is wise. Whether it’s through a portfolio manager or EPM (Equity Portfolio Management) consulting, having experts by your side ensures better decision-making.

In the world of finance, knowledge is power. So, as you navigate the complexities of equity portfolio management, remember that expertise matters.

Your financial future depends on it.

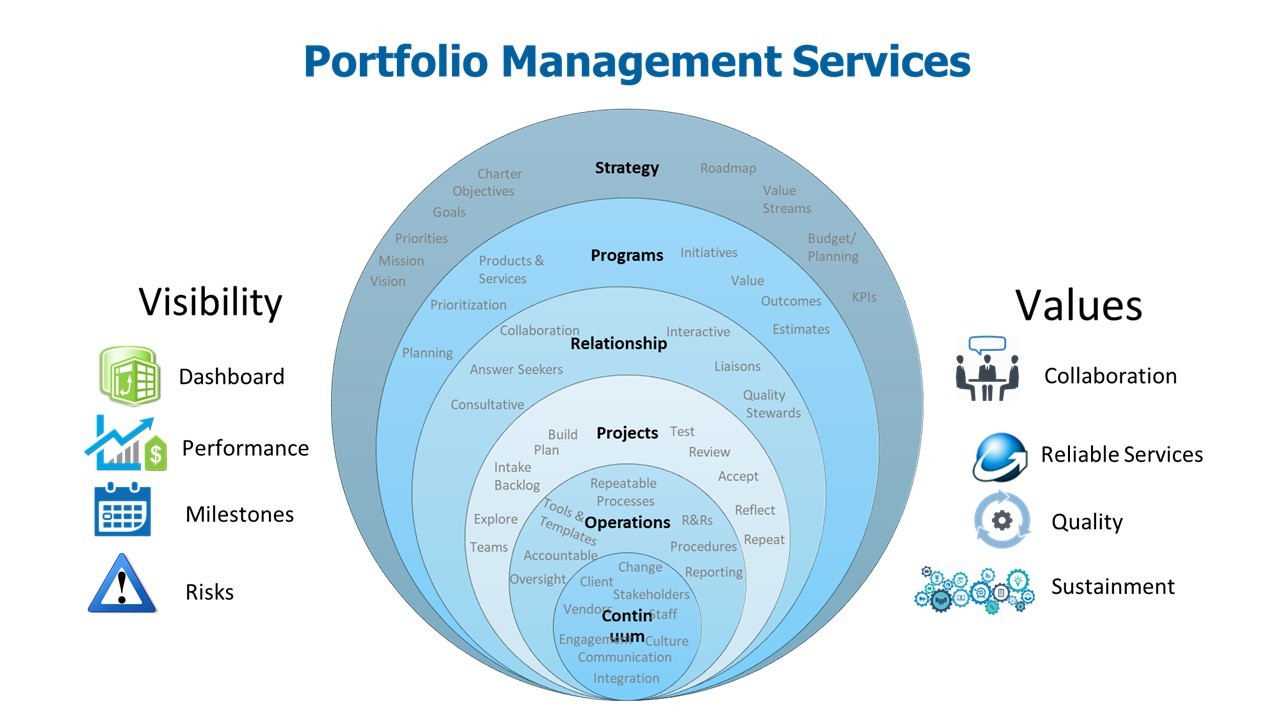

PMs are financial professionals who are critical in managing investment portfolios. They do this either on behalf of clients independently or even institutionally. It’s not just about stock-picking, but rather performing critical analysis on the basis of mathematical principles, renowned portfolio theories, and financial modeling.

Let’s briefly explore the technical aspects that go into investment management and portfolio monitoring.

What Assets, Portion, And Why?

Optimizing allocations is at the core of portfolio management. To effectively do this while closely tracking macroeconomic developments globally, requires an understanding that is much deeper about how markets work and what makes them move.

Tracking and Quantifying Risk

By carefully evaluating the performance of their holdings and the developments in the global markets every day, portfolio managers ensure that the exposed risk is as anticipated depending on the holders of the portfolio.

Factor Models & Attribution Analysis

How do returns work and how can they be consistently predicted? If some assets are out-performing or non-performing, what are the sequence of events that led to those outliers? Portfolio managers use fator tools to elucidate the performance drivers.

Performance Metrics and Monitoring

There’s also a requirement for metrics to gauge risk-adjusted returns and evaluate investment proficiency. Here are some metrics that portfolio managers use to monitor the status of the portfolio performance and measure performance.

Crafting a portfolio that’s resilient and withstands the tough financial waters requires sound scientific principles and creativity. Portfolio managers employ unique methods, ranging from meticulous bottom-up analysis to comprehensive top-down strategies. It’s important to note that there isn’t a perfect recipe and that’s why these expert financial personnel are important. Portfolio advisors and managers acquire specific expertise over vast spans of time usually decades.

Keeping a portfolio happy and resilient requires lots of care and attention. Portfolio managers are dedicated personnel who are interested in the finance domain and follow all the minislule nuances associated with being active in this industry. This also means, they are certified and possess all the certifications required to carry out tasks related to portfolio rebalancing and positioning a portfolio to align them well with desired resk-return profile.

Definition: Rebalancing refers to the periodic adjustment of asset allocations within a portfolio.

Objective: The goal is to maintain the desired risk-return characteristics of the portfolio.

How It Works:

Why Rebalance?:

Importance:

What They Monitor:

Adjustments:

Based on monitoring results, managers may:

Balancing Act:

Risk Assessment:

Managers assess various risks:

Diversification helps mitigate risks.

Scenario Analysis:

Managers communicate with clients:

Transparency builds trust and helps clients stay committed to their long-term goals.

Well, in short, yes!

Although you can start off managing your investments by yourself if your true goal is long-term and wealth building, it’s better you take professional advice and let a portfolio manager handle your portfolio for you. EPM consulting is generally overshadowed when the markets are performing well. But as a serious investor, you should keep in mind that one minuscule error might cause huge deviations in your returns in the long run.

It’s a game-changing decision for sure. Here’s why:

They Are Experts And Expertise Matters.

Equity Portfolio Management (EPM) consulting gives you access to experts who understand financial modeling, risk management, and market dynamics. They’ve weathered market storms and can guide and support you when the markets are taking a toll on you.

They Solve Your Conundrum.

EPM consultants give you any and all essential information while you are making any big decisions. This will reflect in the long-term when you will be reaping the benefits of letting an EPM consultant babysit your growing portfolio.

That’s Just What They Do.

These consultants hold certifications, specialized knowledge and possess all the required and essential certifications to undertake portfolio management. They contemplate your investment goals, chart strategies, project trajectories, and most importantly, they are there to guide you at all times.

Managing your investment portfolio is more than just numbers—it’s about securing your financial future!

If you truly believe that you are better off than dedicated and specialized finance minds, it’s critical you think over another time. Equity portfolio management for building wealth takes patience and expertise. While anyone can learn the required discipline, one has to go to great lengths to truly acquire, appreciate, and advance their knowledge enough to contemplate the happenings and react accordingly.

Sunday, Jun 1, 2025