What We Have To Say

Sunday, Jun 1, 2025

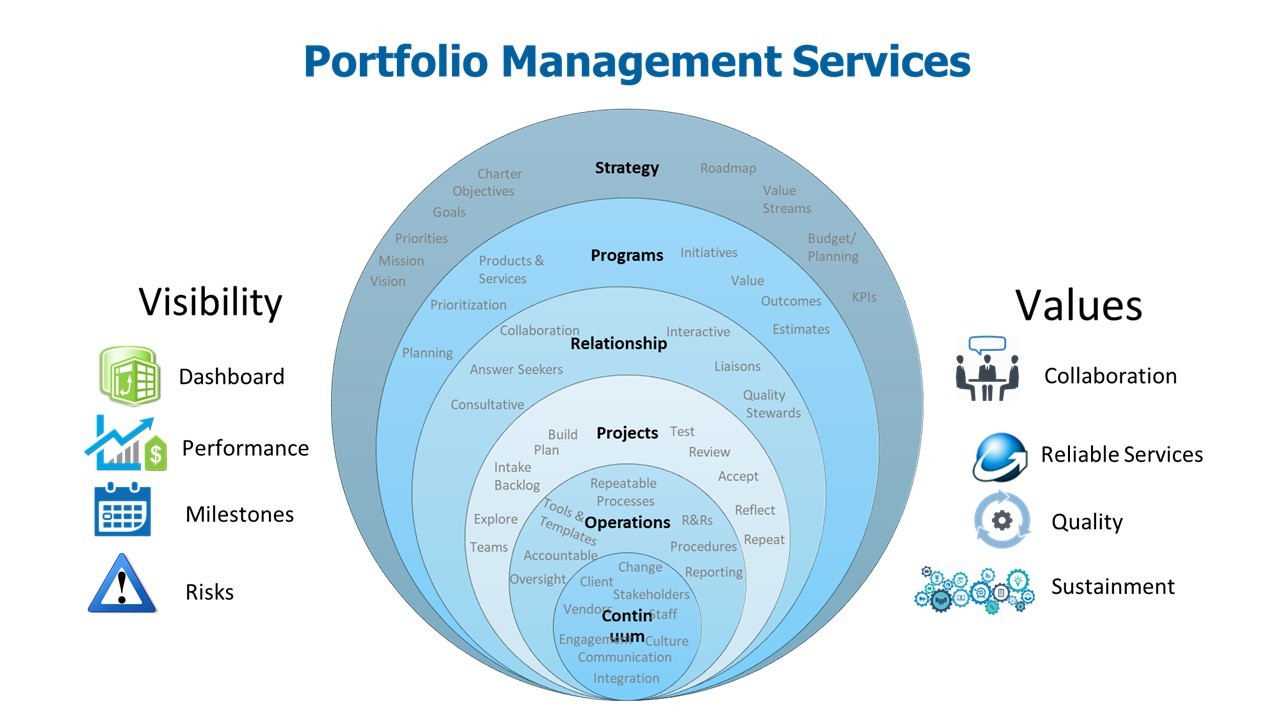

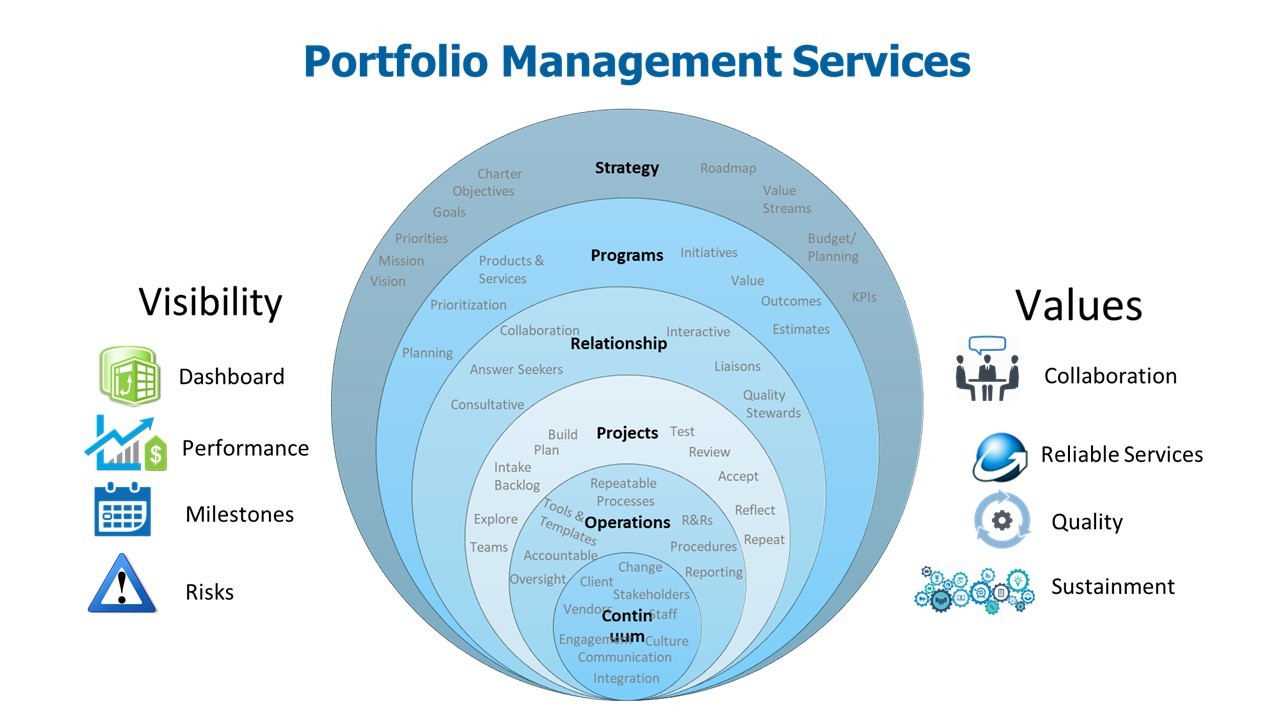

The Ultimate Time Hack: Why PMS is the Smartest Investment for Busy Professionals

Read More

In recent years, Socially Responsible Investing (SRI) has gained significant popularity among investors looking to align their financial goals with their ethical values. One specific category of SRI that has emerged is Shariah Compliant Investments.

Invest Now

These investments adhere to the principles and guidelines set forth by Shariah or Shariat law, which is the moral code of Islam. By investing in Shariah Compliant Mutual Funds and Smallcases, individuals can support companies that operate within the boundaries of Islamic laws and promote social responsibility.

In this blog post, we will explore the features of Shariah Investing and the restrictions imposed by Shariah law.

Features of Shariah Investing

One of the key features of Shariah Compliant Investments is the avoidance of investments that could harm people, the environment, or society as a whole. Consequently, they prohibit investments in businesses that derive a significant portion of their income from activities such as the sale of alcohol, tobacco, pork, weapons, gambling, and pornography.

By excluding these industries, investors can rest assured that their investments are not contributing to practices that contradict their ethical beliefs.

According to Shariah law, money itself has no intrinsic value and should only be used as a medium of exchange. Therefore, earning money from money, such as charging or paying interest (riba), is prohibited. Instead, money should be invested in productive activities that create real value and benefit society. As a result, Muslims are not allowed to invest in companies that blatantly deal with interest. Shariah Compliant Investments avoid all forms of interest by appointing a Shariah board that ensures forbidden sources of income are either avoided or distributed to charitable causes. This emphasis on ethical finance sets Shariah Compliant Investments apart from conventional investment vehicles.

Additionally, Shariah investing requires a balanced distribution of wealth and risk between the parties involved in a financial transaction. This means that investors and investees should share both the profits and losses of their ventures. Furthermore, Shariah investing mandates that investors pay a certain percentage of their wealth as charity (zakat) to purify their income and help the needy.

Moreover, Shariah Compliant Investments tend to avoid excessive risk-taking. They refrain from investing in companies involved in high-risk activities or those burdened with significant debt.

Derivatives and fixed-income instruments are also excluded from their investment portfolios. By adopting a more cautious approach, Shariah Investing aims to protect investors while upholding the principles of Shariah law. It's worth noting that Shariah Investing Smallcases and Mutual Funds are not limited to followers of Islam. Investors from all religious backgrounds are welcome to invest in these funds. This inclusivity allows individuals who value socially responsible investing to participate in a financial framework that aligns with their beliefs.

Conditions for an Investment to be labelled as Shariah Compliant

To be labelled as a Shariah Compliant Investment, there are specific rules and restrictions that these investments must follow.

Firstly, they cannot invest in companies whose total debt exceeds one-fourth of their total assets. This measure helps mitigate the risks associated with highly indebted companies. Additionally, these portfolios can invest in companies that generate interest income up to 3% of their total income. Since finding companies with 100% interest-free income is nearly impossible, this threshold provides some flexibility while maintaining adherence to Shariah principles. Furthermore, Shariah Compliant Investments cannot acquire shares of companies involved in financial services, such as banks and insurance companies, or those engaged in the manufacturing of liquor, pork, tobacco, gambling, nightclub activities, and pornography.

Merits of Shariah Investing

Shariah Compliant Investing has the following advantages.

Challenges Associated with Shariah Investing

While Shariah Compliant Investments offer investors a socially responsible investment option, it is crucial to recognize that these portfolios have a narrower investment focus due to the restrictions imposed by Shariah law. The returns of these investments are tied to the performance of the specific sector of Shariah compliant companies, which may have different dynamics compared to conventional investments. Therefore, it is essential for investors to carefully consider the pros and cons before investing in Shariah Compliant Stocks.

How to Invest in Shariah Compliant Stocks

Shariah investing can be done through various instruments, such as equity, real estate, commodities, sukuk (Islamic bonds), mutual funds and smallcases. However, finding Shariah-compliant investments can be challenging, especially in India where there are limited options available.

One way to overcome this challenge is to invest in Shariah-compliant smallcase portfolios, which are professionally managed investments in a diversified portfolio of stocks that adhere to the Shariah principles. This basket of stocks have a Shariah board of Islamic scholars who screen and monitor the investments for compliance.

Sunday, Jun 1, 2025