Portfolio Diversification Strategies for Maximizing Returns and Minimizing Risk

Sunday, Feb 5, 2023

Investing in the stock market can be a great way to grow your wealth over time, but it also comes with its own set of risks. This is why it's important to diversify your portfolio, spreading your investments across different assets and industries, to minimize your risk and maximize your returns. If you're looking for ways to do this, you may want to consider working with a portfolio management firm in India such as Green Portfolio.

What is Portfolio Diversification?

Portfolio diversification is the process of spreading your investments across different assets, industries, and geographical regions to reduce the risk of your portfolio as a whole. The idea is that if one of your investments performs poorly, it will have a smaller impact on your overall portfolio if you have other investments that are performing well.

Why is Portfolio Diversification Important?

There are many reasons why portfolio diversification is important, but here are a few of the most significant:

Minimizes Risk:

By spreading your investments across different assets, industries, and regions, you can reduce the risk of your portfolio as a whole. This is because the performance of one investment is not likely to have a significant impact on the overall performance of your portfolio.

Increases Returns:

By diversifying your portfolio, you can also increase your returns. This is because different investments perform differently in different market conditions, and by having a well-diversified portfolio, you can take advantage of the performance of different investments at different times.

Helps with Long-Term Planning:

Portfolio diversification can also help you with long-term planning. By spreading your investments across different assets and industries, you can ensure that your portfolio is well-positioned to perform well over the long term, regardless of market conditions.

How to Diversify Your Portfolio

There are many ways to diversify your portfolio, and the best approach will depend on your individual circumstances, goals, and risk tolerance. However, here are a few common strategies that you may want to consider:

Asset Allocation:

This involves spreading your investments across different asset classes, such as stocks, bonds, and real estate. This can help to reduce the risk of your portfolio, as different asset classes perform differently in different market conditions.

Industry Diversification:

This involves spreading your investments across different industries, such as technology, healthcare, and energy. This can help to reduce the risk of your portfolio, as different industries perform differently in different market conditions.

Geographical Diversification:

This involves spreading your investments across different geographical regions, such as the United States, Europe, and Asia. This can help to reduce the risk of your portfolio, as different regions perform differently in different market conditions.

Working with a Portfolio Management Firm in India

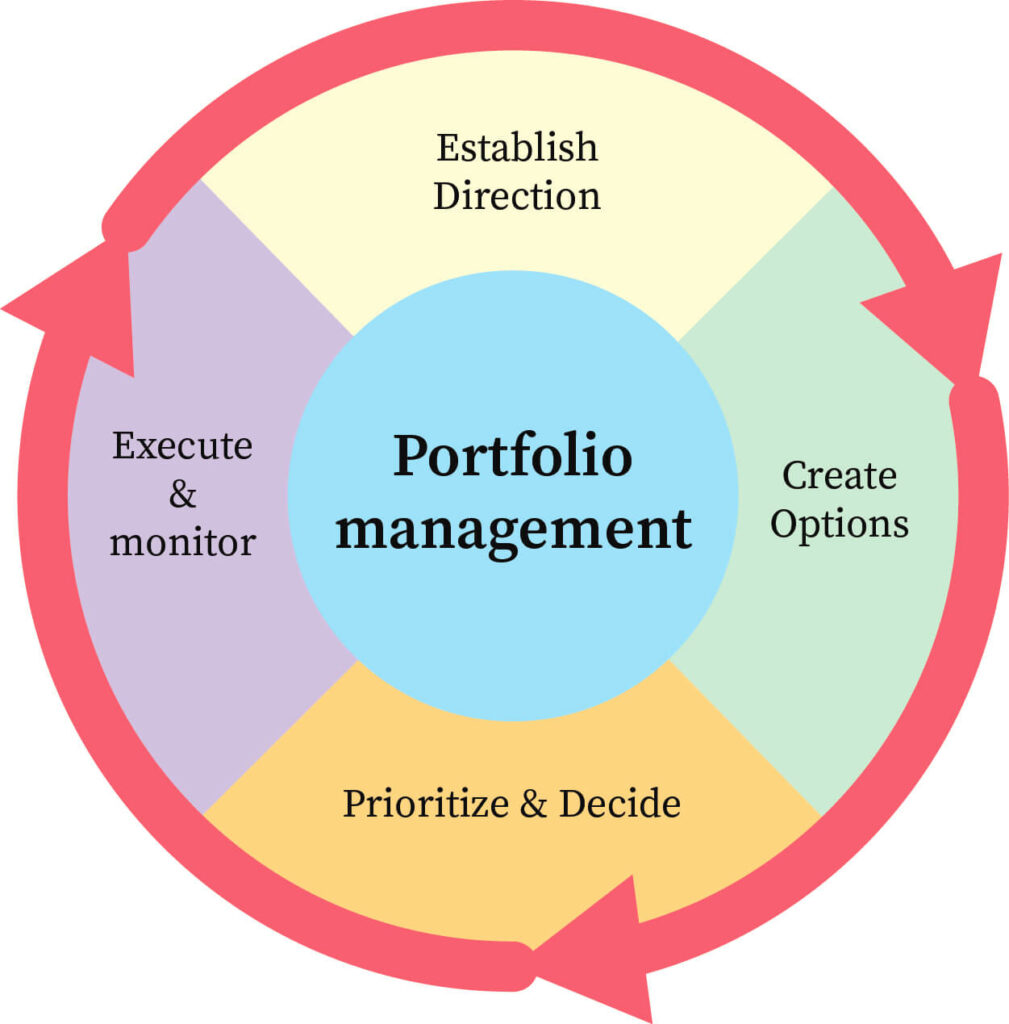

If you're looking for help with portfolio diversification, you may want to consider working with a portfolio management firm in India. These firms can provide a range of services, including:

Investment Advice:

A portfolio management firm can help you to determine the best investment strategy for your individual circumstances, goals, and risk tolerance.

Portfolio Management:

A portfolio management firm can help you to manage your portfolio, making investments on your behalf and adjusting your portfolio as needed to ensure that it is well-diversified and performing as you want it to.

Monitoring and Reporting:

A portfolio management firm can also help you to monitor your portfolio and provide regular reporting, so you can see how your investments are performing and make any necessary adjustments.

Conclusion

Portfolio diversification is a critical aspect of investing in the stock market. By spreading your investments across different assets, industries, and regions, you can reduce the risk of your portfolio and maximize your returns. There are several strategies for diversifying your portfolio, including asset allocation, industry diversification, and geographical diversification.

If you need help with portfolio diversification, you can consider working with a portfolio management firm in India. These firms can provide investment advice, portfolio management, monitoring, and reporting, allowing you to make informed decisions and achieve your financial goals.

Talk to an expert

Talk to an expert