Trusted by 65,000+ investors worldwide!

Trusted by 65,000+ investors worldwide!

Upgrade To Research-backed Equity Investing

Unlock better performance, clarity, and confidence.

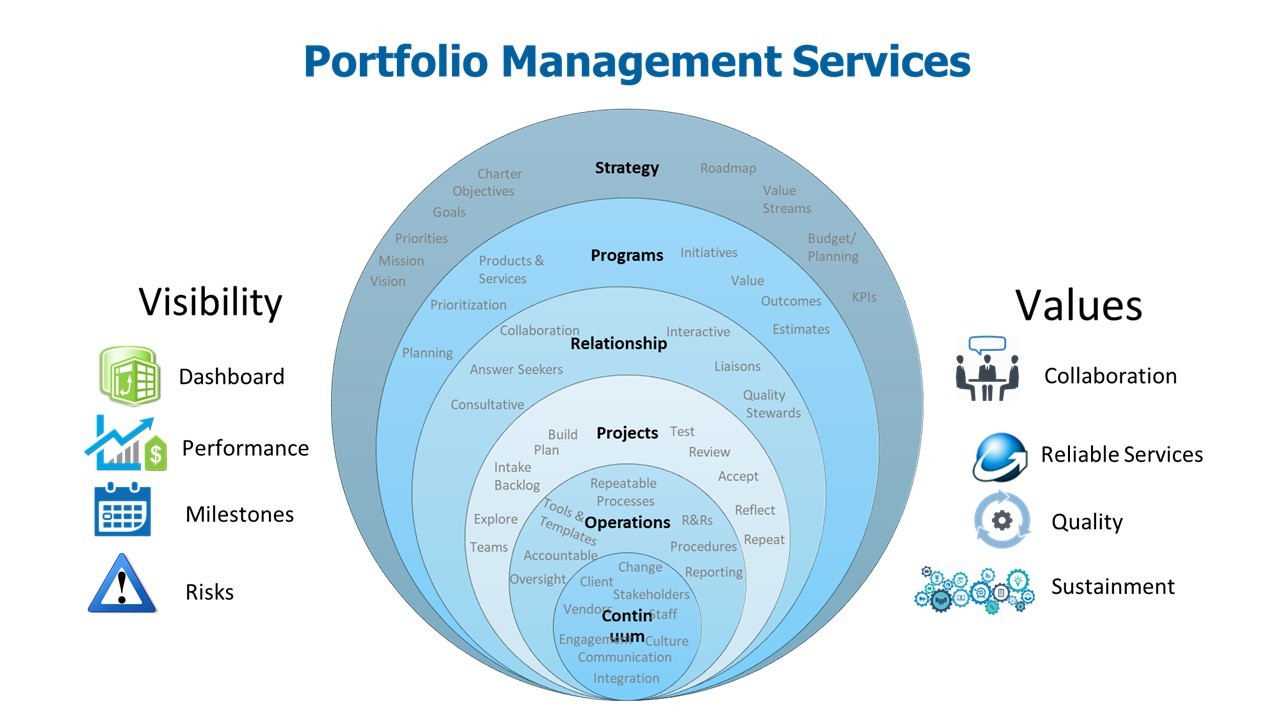

Invest across smallcases, PMS, and AIF..

Get Personalized Advice

Get Personalized Advice

24.3%

24.3%

Book A Free Call

Book A Free Call

Talk to an expert

Talk to an expert